In the fourth quarter, Retirement Systems of Alabama reduced its AutoNation stock by 10.9%. According to their latest SEC filing, they held 0.09% of AutoNation with 45,083 shares worth $4,837,000.

AutoNation is a major American automobile supplier. Domestic franchisees selling new General Motors, Ford, and Stellantis automobiles make up four primary segments.

AN has received mixed reviews from research firms. In an April 17th report, Guggenheim boosted their price objective on AutoNation from $181.00 to $184.00, giving it a “buy” rating.

JPMorgan Chase & Co lowered AutoNation after boosting their target price from $125.00 to $130.00, while Wells Fargo & Company upgraded from “equal weight” to “$144 significantly.” StockNews.com suggested millennials investigate AutoNation for growth or yield.

In conclusion, investing in AutoNation’s stock can be difficult due to investment analysts’ conflicting opinions about its potential future performance compared to market prices or expected returns on investment portfolio options based on present value calculations or other valuation models used worldwide today depending on investors’ expectations and preferences when considering their risk management strategies.

The consensus among analysts sees AN trading currently at “Hold,” with a mean price target estimated at $153.14, which could provide cautious investors with some good value investing opportunities this year after thorough analysis. Before making any decisions, investors should ensure a thorough analysis of all available data, risk appetite, preference, and expectation.

AutoNation Inc.: Institutional Holdings Changes

AutoNation, Inc. is a top automotive supplier. As a publicly listed corporation, institutional holdings and insider trading have been reported.

Institutional investors acquire publicly traded company shares with pooled money. Several institutional investors and hedge funds have changed their AutoNation holdings. Last quarter, BlackRock Inc., Goldman Sachs Group Inc., Barclays PLC, Vanguard Group Inc., and Royal Bank of Canada bought millions of AutoNation shares.

EVP C Coleman Edmunds and key shareholder Edward S. Lampert sold a lot of shares in March and May 2021, respectively, while institutional investors strengthened their stakes. Insider sales totaled millions.

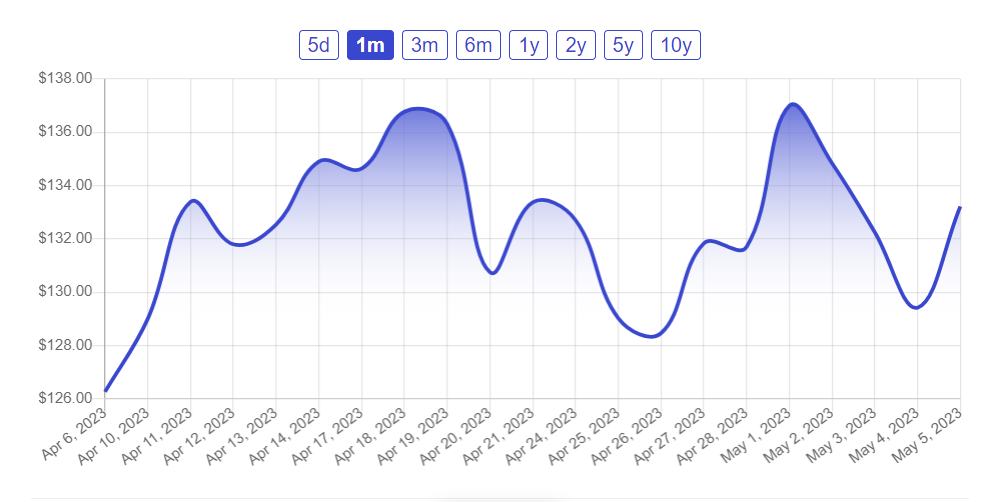

AN stock opened Friday at $129.42 with a market cap of $5.90 billion, beta of 1.08, PEG ratio of 0.26, price-to-earnings ratio of 5.27, and debt-to-equity ratio of 1.91.

On April 20, AutoNation reported $6.07 EPS, $0.47 over analysts’ consensus projections.

AutoNation is a prominent automaker, but institutional holdings and insider selling may make investors wary of investing in the shares.

Disclaimer: This material is for informative purposes only and not investment advise from OpenAI’s GPT-3 or GPT-2 language models or our team’s human authors. Research before investing.