As a result of increased sales of its more expensive electric vehicles, Rivian Automotive reported quarterly revenue that was far higher than analysts had anticipated.

The manufacturer of automobiles also maintained its previous projection that it would produce 50,000 vehicles year.

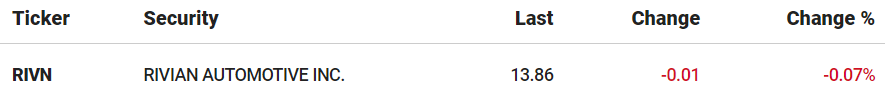

During prolonged trading, Rivian share prices rose by more than 5 percent.

Rivian went against the trend that was noticed by its competitors Lucid Group and Fisker Inc., which both lowered their manufacturing objectives.

Reaching its goal and compensating for problems with the availability of parts are both made easier by the anticipated manufacturing ramp up of its in-house Enduro powertrains.

The R1T pickup trucks from Rivian have a starting price of $73,000, while the R1S SUV has a price point of $78,000.

According to statistics provided by Refinitiv, the company’s revenue for the quarter that ended on March 31 was at $661 million, which is higher than the Wall Street projections of $652.1 million.

When compared to the previous three-month period’s total cash and cash equivalents balance of $11.57 billion, the cash and cash equivalents balance at the end of the first quarter was $11.24 billion.

The quarterly net loss for Rivian decreased to $1.35 billion, down from $1.59 billion a year earlier when it was reported.

The business disclosed in January that it will be laying off 6% of its workers in an effort to reduce expenses while simultaneously growing production in an electric vehicle (EV) industry that is becoming increasingly competitive.

The beginning of the new year saw the departure of many senior officials from the electric vehicle (EV) firm, including the vice president who oversaw body engineering and the head of supply chain.