Kaiser Aluminum Corp., which manufactures and distributes semi-fabricated specialty aluminum products, had one of its institutional investors significantly reduce its shares. Russell Investments Group Ltd. cut its holdings by 17.5% in the fourth quarter, according to the forthcoming SEC report.

This investor had 215,204 Kaiser Aluminum shares before selling 45,526 throughout the time. Russell Investments Group Ltd owned little over $16 million, or 1.35% of Kaiser Aluminum Corp. shares.

Kaiser Aluminum Corp. still makes specialist aluminum products for aerospace, general engineering, automotive, and specialty industrial applications clients despite this evolution. It sells plate, sheet, coil, hard alloy forms, soft alloy extrusions, seamless and structural extruded drawing tubes.

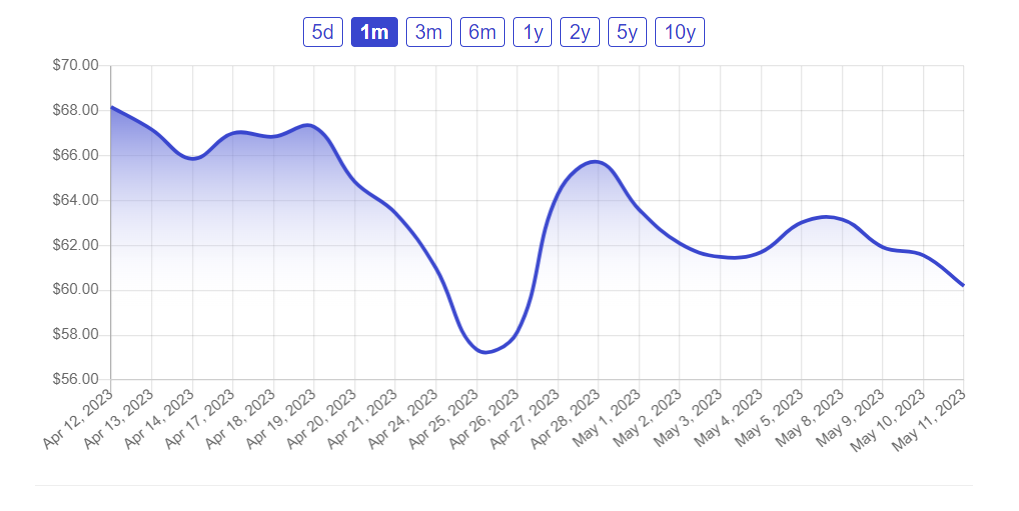

KALU shares opened at $61.56 on Thursday amid Russell Investments Group Ltd. stake reduction rumors. The firm’s quick, current, and debt-to-equity ratios are 1:29, 2:61, and 1.70, respectively.

Kaiser Aluminum Co. had a market capitalization of $983.73 million, a PE ratio of -44.61, and a beta risk factor of 1:28, reaching its highest point trading at $107:41 per share and dropping to a lower value trading price following the opening bell on Thursday at $56:79.

Overall, understanding financial instrument nuances and complexity is essential for good management decision-making, and investment techniques are crucial.

Kaiser Aluminum: Quality Products and Institutional Investment Interest Despite Skepticism

Kaiser Aluminum Corp. sells semi-fabricated specialized aluminum products. The firm serves aerospace, automotive, general engineering, and specialized industrial applications. Kaiser Aluminum manufactures excellent goods to strict requirements, including plate, sheet, coil, hard alloy forms, soft alloy extrusions, seamless and structural extruded drawing tube, hard alloy rod, bar, wire, and forging stock.

Institutional investors and hedge funds have lately purchased and sold Kaiser Aluminum shares due to its strong portfolio. BlackRock Inc. bought 22,167 Kaiser Aluminum shares worth $246 million in the first quarter, increasing its holdings by 0.9%. After buying 40,795 shares last quarter, Vanguard Group Inc. now owns 1.9 million industrial products business shares.

Despite Kaiser Aluminum’s recent investments in its industry leadership and Q1 profits that above projections, several analysts remain pessimistic about its future prospects. JPMorgan Chase & Co., Benchmark Research, and The Goldman Sachs Group reported investor pessimism.

Kaiser Aluminum’s Q1 return on equity (-3.35%) and net margin (-0.65%) despite positive earnings per share ($0.42) contributed to this mistrust. Q1 sales was $808 million, barely below projections, but 14.9% lower than last year.

Kaiser Aluminum will pay a $0.77 quarterly dividend to stockholders of record on April 25th on May 15th following these mixed Q1 2023 results. This yields 5.00% on a $3.08 yearly dividend.

After reviewing the facts, we can conclude that Kaiser Aluminum is a good firm with some residual doubts about its future prospects that have forced several analysts to give the stock sell ratings. Kaiser Aluminum remains an industry leader due to their high-quality products and strict manufacturing standards, but it is unclear if these predictions will come true or if institutional investors will continue to invest in them.