Pacer Advisors Inc.’s SEC Form 13F filings show a 12,086.7% gain in Energizer Holdings Inc. shares. The company’s Energizer shares increased from 105 to 12,796 in the fourth quarter of last year, according to reports. These shares are worth $429,000, telling investors that the worldwide corporation is growing.

Energizer reported Q4 2016-17 earnings per share slightly below analyst forecasts. Industry insiders still see the business as a leader due to its strong return on equity and active expansion in automotive supplier markets.

Under Battery and Lights and Auto Care, Energizer designs and sells lighting products, home batteries, specialty batteries, and other related things. Recent Energizer product introductions have been praised for their potential.

Despite concerns about quarterly revenue falling 9.6% YoY, experts believe Energizer will remain a powerhouse in its business sectors, targeting continued innovation across its range of electrically-run products and stable investment interest.

Despite recent setbacks, equity research experts expect ENR’s EPS to end slightly around three dollars next year, indicating that the company’s outlook remains positive. Their situation appears solid for now, but we’ll keep an eye out for more information.”

Energizer Holdings Inc. Increases Institutional Investor Stakes and Plans Investments

Institutional investors have increased their positions in Energizer Holdings, Inc., a battery and lighting firm. After buying 6,623 shares in the fourth quarter, Asset Management One Co. Ltd. owns 82,917 Energizer shares worth $2,849,000. ARGI Investment Services LLC also increased its Energizer stake by 13.9%.

Recently, other investors have increased or decreased their Energizer interests. Ironwood Investment Counsel LLC and Bank of Montreal Can bought shares, while ProShare Advisors LLC grew its stake by 15.4%.

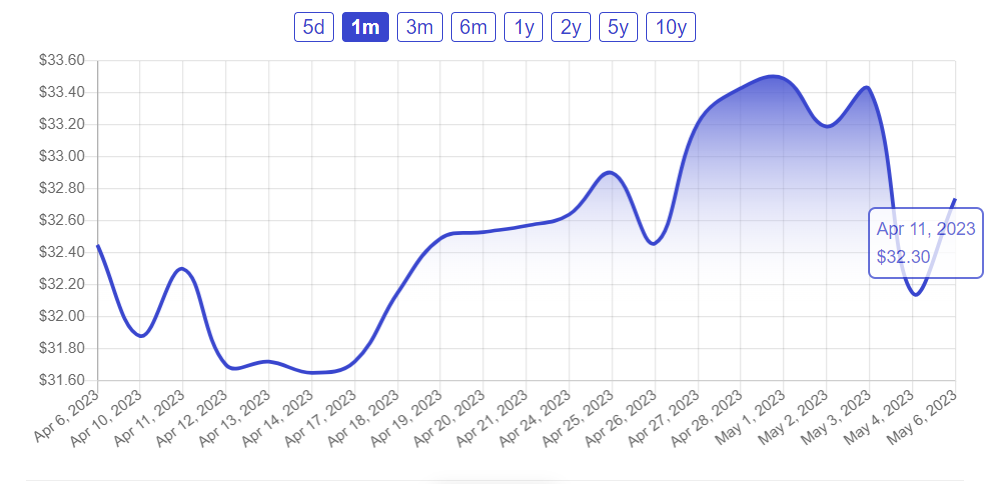

Institutional investors now hold over 88% of Energizer stock. ENR began Friday at $32.15 with a $2.30 billion market cap.

Energizer has two segments: Battery and Lights and Auto Care, which creates and sells automobile aesthetic, performance, refrigerant, and freshener products.

The company will pay stockholders on record as of May 22nd quarterly dividends on June 13th. These stockholders will get a $0.30 dividend per share for a $1.20 annualized dividend and 3.73% yield.

Several research experts have given the firm buy-to-hold recommendations, predicting consistent growth for potential investors in the following several months after the price last went above average.

Investors are watching how Energizers Holdings Inc. plans to capitalize on floor-planning initiatives as COVID-19 restrictions ease in hopes it won’t hurt revenue growth and investments.